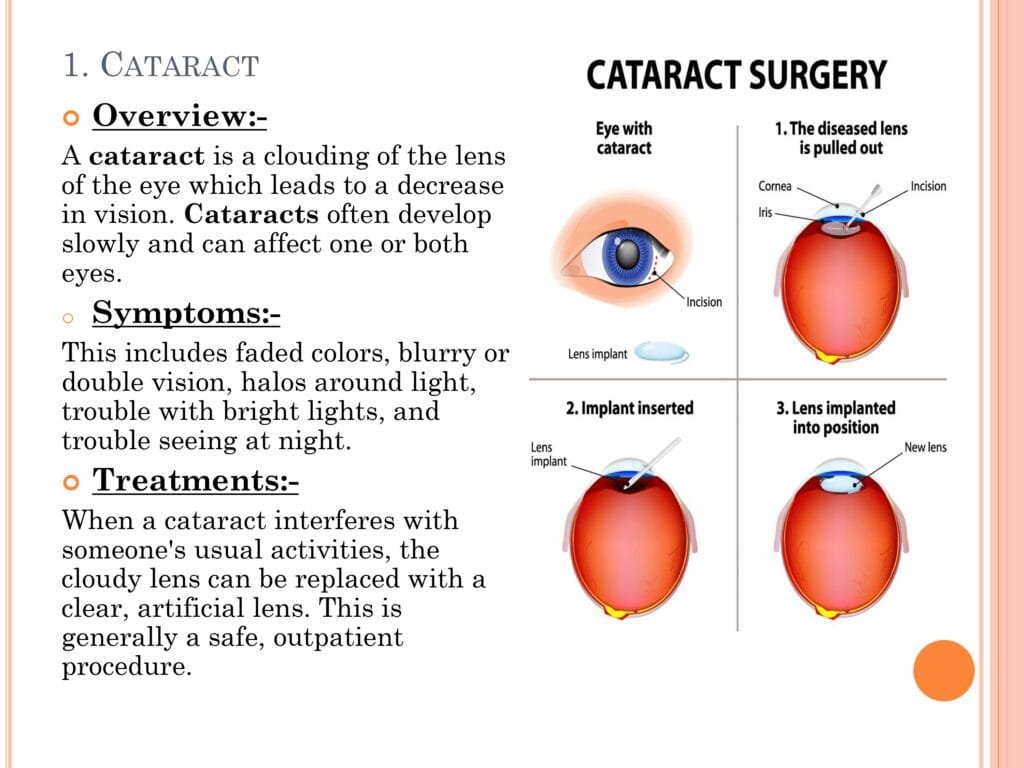

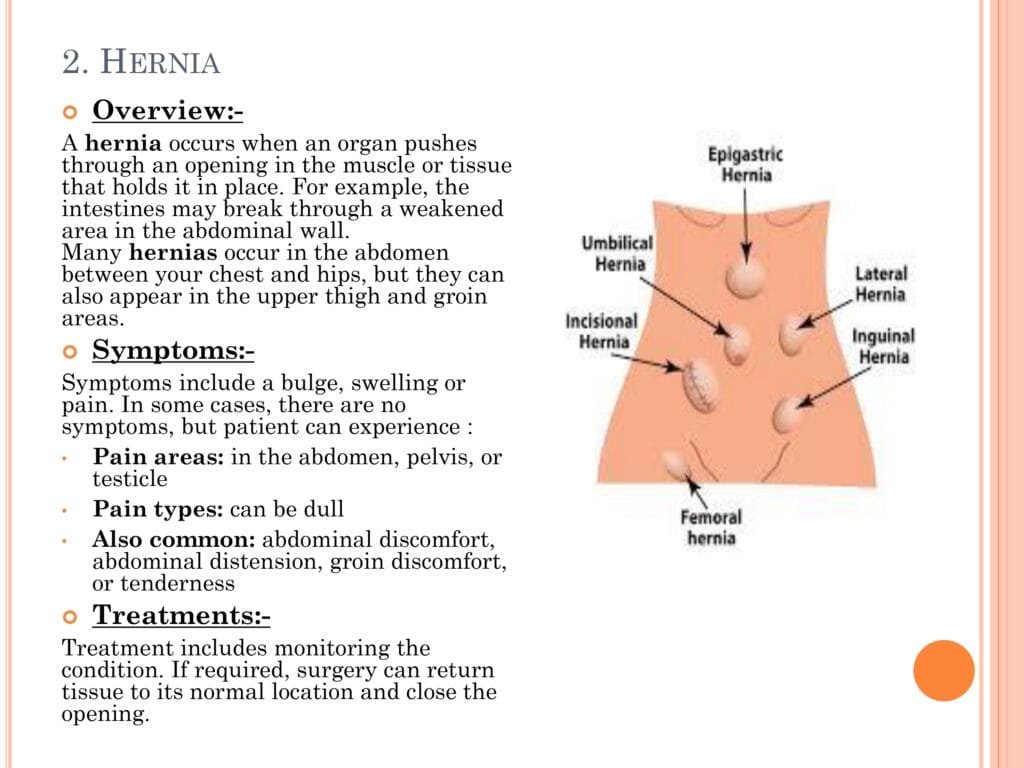

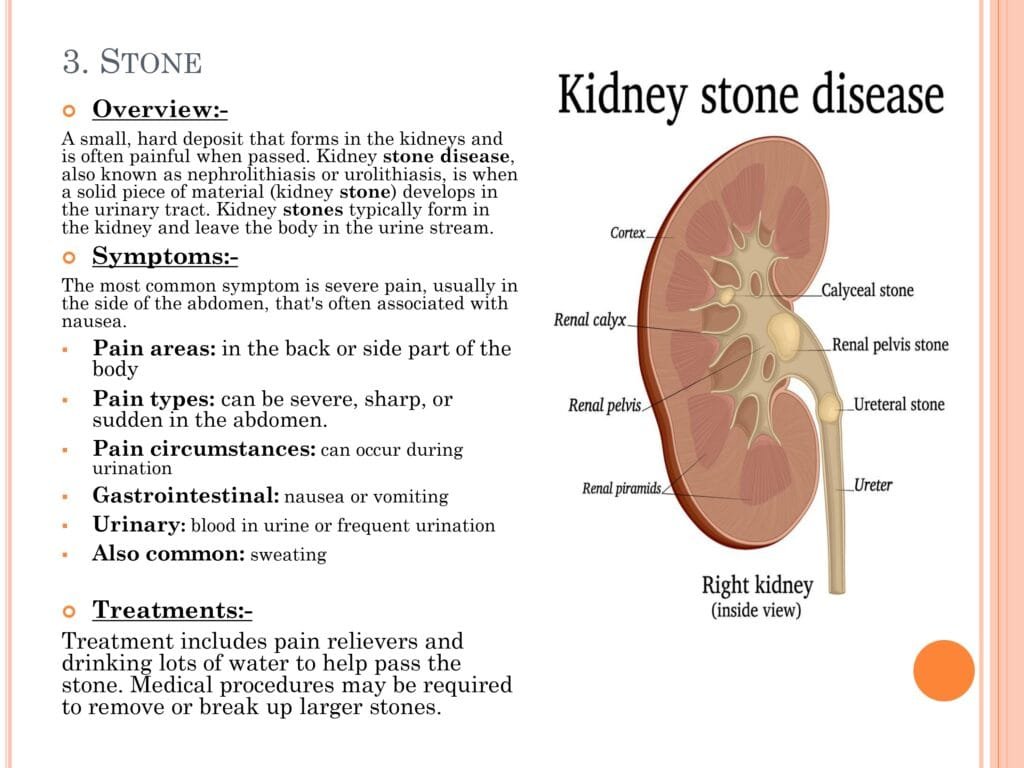

The 2 year Specific Ailment & Procedures Waiting Period in health insurance is a predetermined time frame, often one or two years, during which coverage for certain specified ailments and procedures, such as ENT disorders, hernia, osteoporosis, joint replacement surgery, cataract, and more, is not provided. After this waiting period has passed, the insurance policy will cover medical expenses related to these conditions.

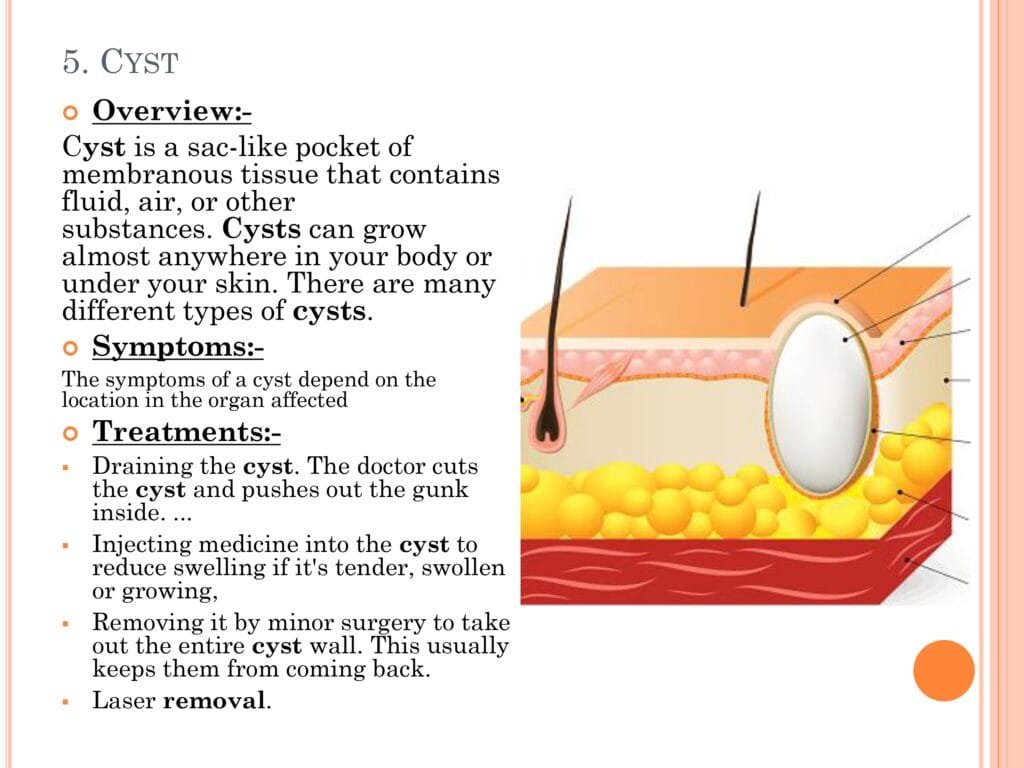

There are 14 types of diseases in 2 years waiting period list :-

CATARACT

HERNIA

STONE

PILES

CYST

TUMOR

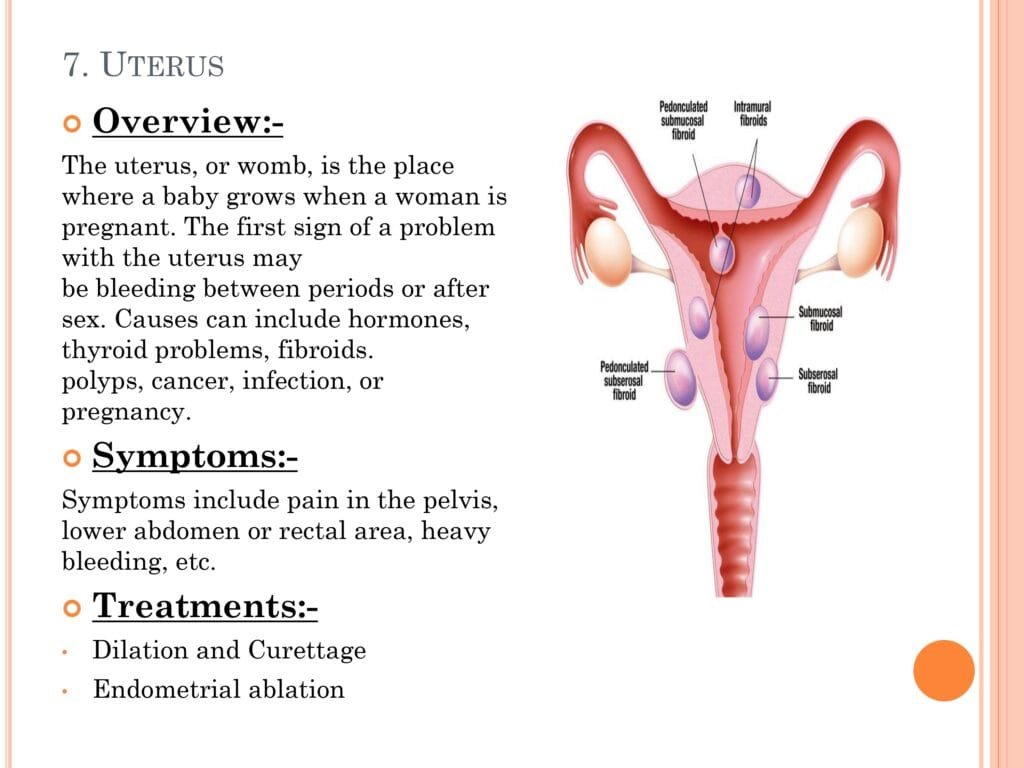

UTERUS

PROSTATE

LIGAMENT

VEINS

SPINAL

ENT EAR

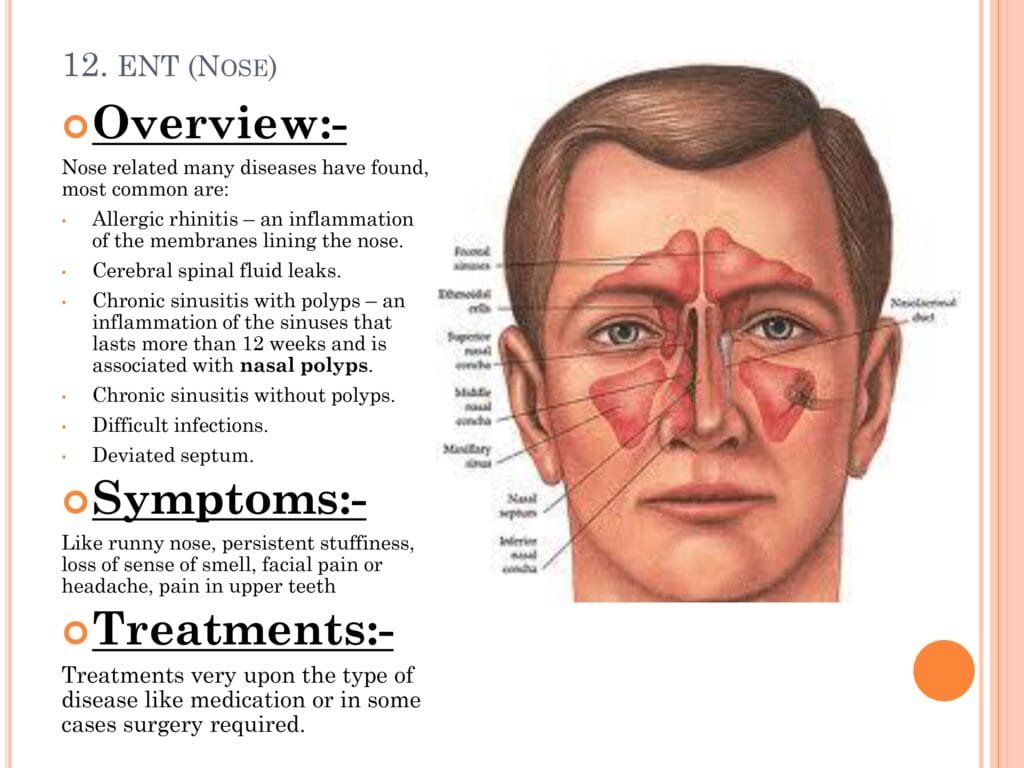

ENT NOSE

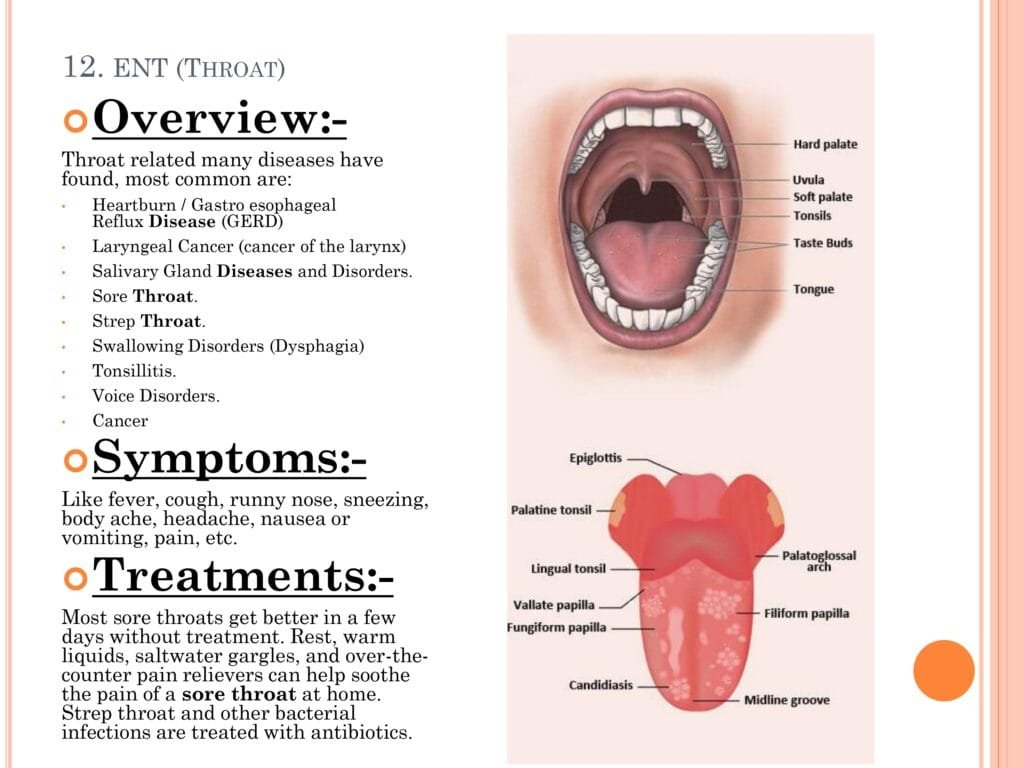

ENT THROAT

Parkinson & Alzheimer

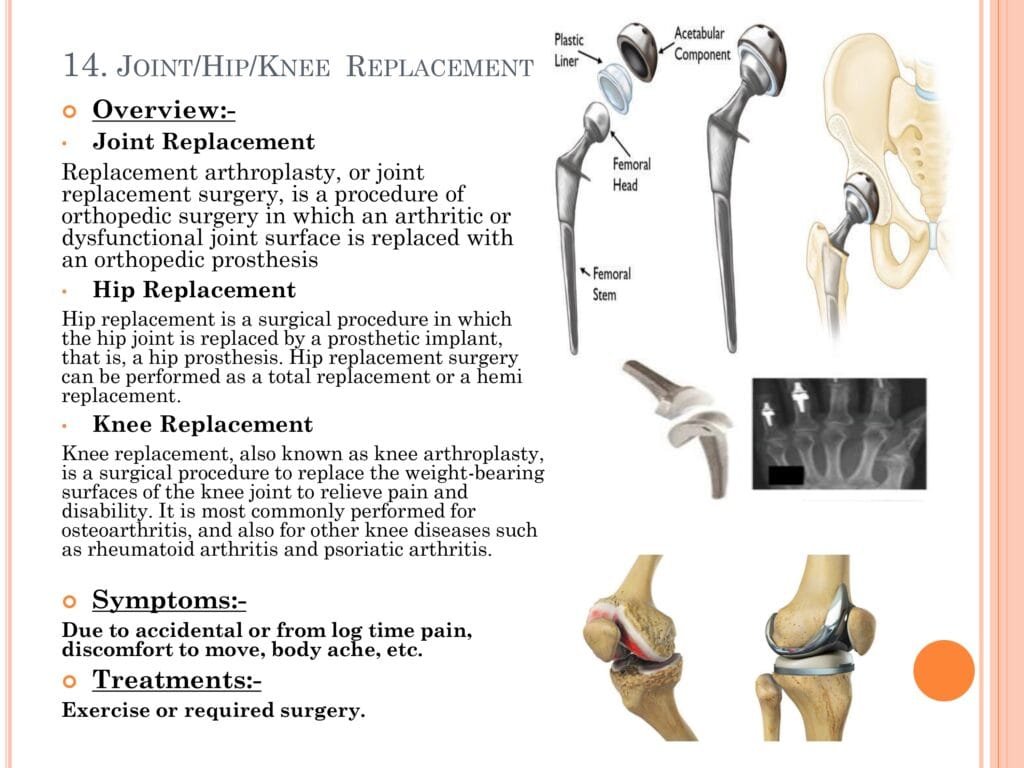

Joint/Hip/Knee Replacement

Why does it exist?

Insurance companies implement this waiting period to:

- Mitigate risk: They want to avoid covering pre-existing conditions or those that were likely to occur soon after the policy purchase.

- Maintain premium affordability: By excluding certain high-cost procedures initially, they can offer more affordable premiums.

How to navigate it:

- Read your policy document carefully: Understand the exact list of conditions and procedures covered by the waiting period.

- Choose wisely: Opt for a policy with a shorter waiting period if possible. Some insurers offer plans with shorter waiting periods for specific conditions.

- Consider add-on covers: You might be able to purchase add-on covers to reduce the waiting period for certain conditions.

- Be honest in your health declaration: Providing accurate information is crucial to avoid claim rejections.

Additional Tips:

- Buy early: The younger you are when you buy health insurance, the longer you have to wait out the waiting period.

- Maintain a healthy lifestyle: This can help prevent many of the conditions covered by the waiting period.

- Review your policy regularly: Ensure you understand the terms and conditions and any changes that may have occurred.

By understanding the 2-year specific ailment and procedures waiting period, you can make informed decisions about your health insurance coverage and protect yourself financially in case of unforeseen medical emergencies.